Equip your firm to navigate crypto’s complexities. This post provides essential strategic crypto insights for professional service firms in Web3, ensuring you avoid costly crypto mistakes! #cryptoaccounting #crypto #digitalassets #cryptosecurity #cryptobookkeeping

✅ Strategic Compliance: 5 Crypto Tips for Professional Service Firms in Web3

Cryptos and fintech form a complex and rapidly evolving landscape, and even seasoned adopters can make costly mistakes. As a CFO, accountant, or Web3 executive, you have a crucial role to play in guiding your firm towards safe and successful crypto practices to better serve your clients. The good news is that many mistakes most businesses make are avoidable with the right knowledge and guidance.

In the evolving landscape of Web3, strategic compliance and optimized digital asset management are paramount for professional service firms. This article offers essential guidance to empower your finance leadership, enabling stronger investment protection, robust risk mitigation, and truly informed strategic choices. Continue reading to solidify your expertise and unlock the full potential of digital assets for your practice.

By the way, some links in this publication may be affiliate links, which means we earn a commission at no extra cost to you. Thank you for learning how to improve your crypto compliance with mrBlockchainMan.

Tip #1 ~ Educate Your Team on the Crypto Basics

Understanding the crypto accounting basics is crucial for guiding your team through the fundamental changes impacting digital commerce.[1] Let’s explore some essential concepts:

Cryptographic Assets

Crypto assets are digital assets that use cryptography for secure transactions and control. They can be decentralized, operating without central authorities, or issued and managed by them. This flexibility, combined with careful governance mechanisms, creates unique and scarce digital assets.

Distributed Ledger Technology (DLT)

DLT is the technology that underpins all cryptographic assets. A distributed ledger is a database that is shared and synchronized across multiple computers in a network. This makes it incredibly secure and transparent, as no single entity controls the ledger. Blockchain is a well-known type of DLT.

Digital Scarcity

Combining cryptographic assets and DLT networks results in digital scarcity. This means that the supply of any crypto is controlled by its underlying code and is provably unique, much like physical resource scarcity for gold or diamonds. Scarcity is a key concept to help clients grasp how crypto wallets work and better understand the transformational potential it provides savvy users.[2]

Crypto Wallets

Wallets are like digital keyrings for managing your scarce crypto assets. They store your private keys, which are secret codes that allow you to access and control your crypto. Remember, your crypto isn’t actually in your wallet—it resides on the ledger. Your wallet simply holds the keys that allow you to interact with it in many ways, like on exchanges.

Crypto Exchanges

Crypto exchanges are digital marketplaces where you can buy, sell, and trade crypto assets. While you might have an account on an exchange, your crypto isn’t necessarily “held” there in the same way it might be in a traditional bank account. Often, exchanges hold your crypto in a custodial wallet on your behalf.

With exchanges frequently holding crypto in custodial wallets, the user’s ability to easily manage their assets becomes paramount. Therefore, when recommending platforms to clients, the importance of user-friendly platforms and GUIs cannot be overstated.

User-Friendly Platforms & GUIs

Comprehensive crypto accounting means crafting the right fintech stack because it’s crucial for success. This includes selecting user-friendly wallets, exchanges, payment interfaces, and dApps which align with your business goals and risk tolerance. Prioritize platforms with intuitive interfaces and robust customer support. This will not only empower you to manage your digital assets with confidence but also minimize the risk of costly errors. As their CFO or accountant, your guidance in this area can be invaluable in ensuring a smooth and successful integration.

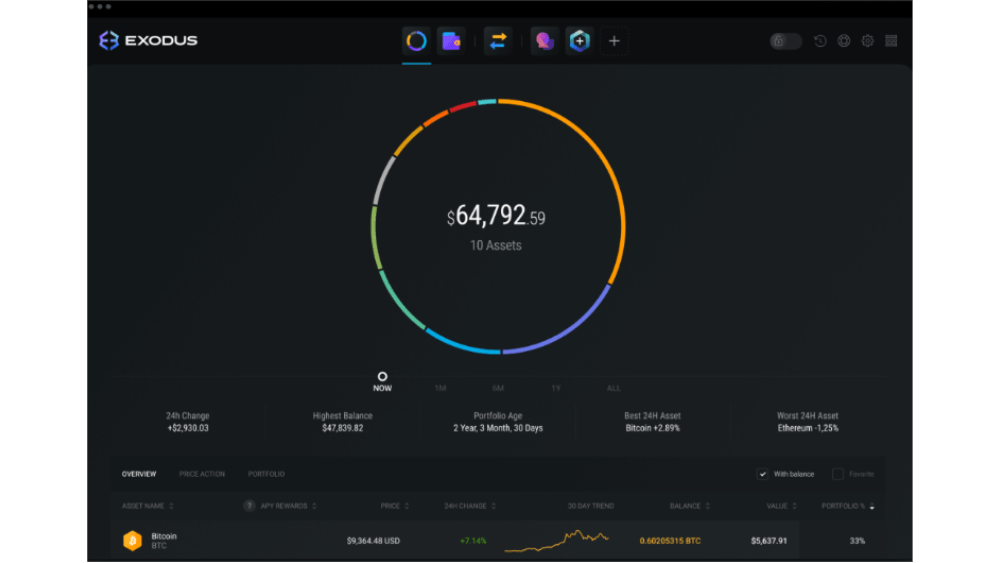

Here’s an example of a popular and user-friendly GUI, made by Exodus.™

Exodus wallet GUI screenshot from Exodus.com

When choosing crypto platforms, it’s essential to consider the user experience. GUI aspects such as layout, error rate, extensibility and speed can mean the difference between a great experience or lost crypto. A user-friendly interface can significantly impact your success and minimize the risk of costly errors.

Key Aspects to Evaluate:

- Intuitive Design: Look for platforms with clear navigation, easy-to-understand terminology, and helpful guides or tutorials.

- Functionality: Ensure the platform offers the features and tools your clients need, such as portfolio tracking, transaction history, and security settings.

- Customer Support: Prioritize platforms with responsive and reliable customer support, including options like chat, email, or phone assistance.

- Security: Verify that the platform has strong security measures in place to protect client funds and data.

Due Diligence is Key

Before choosing any crypto platform, take the time to familiarize yourself with its features, functionality, and user experience. This will enable you to gain valuable hands-on experience and help you make the best choices for your firm’s needs.

Remember: A user-friendly platform can empower you to confidently manage your crypto assets and reduce the risk of errors. Your ability to select the right tools is crucial for your firm’s success in the crypto space.

Next, let’s delve deeper into the crypto ecosystem by exploring the key players who drive its development, functionality, and adoption. Understanding these roles is crucial for developing the insights you’ll need while building your optimal digital treasury.

Who’s in Charge? Understanding Key Roles in Crypto Networks

As a CFO, accountant, or Web3 executive, understanding the six key roles within a crypto network is crucial for assessing its stability, security, and potential risks. This knowledge empowers you to make informed recommendations and guide your firm towards a responsible crypto integration with your business ops.

Two key roles are particularly important for your team to understand:

- Administrators: These individuals or groups govern and guide the development of crypto networks. They establish rules, control user access, and ensure the network’s smooth operation. Their decisions can significantly impact the stability and security of the crypto asset.

- Participants (or Validators): These individuals or groups validate and process transactions on the network. They ensure the accuracy and integrity of the blockchain, which is crucial for maintaining trust and transparency.

Why These Roles Matter for Web3 Pros:

- Governance and Compliance: Understanding the governance structure of a crypto network can help you assess its compliance with relevant regulations and identify potential risks for your firm or clients.

- Transaction Verification: The validation process ensures the accuracy and reliability of transaction records, which is essential for accounting and auditing purposes.

- Security and Stability: The roles of administrators and participants are crucial for maintaining the security and stability of the crypto network, which ultimately impacts the value and trustworthiness of the crypto asset.

When guiding your team on choosing crypto platforms and assets, encourage thoughtful discussion about these questions:

- User Base: Where are the users located, and how active is the community?

- Issuance: Who can issue the crypto, and under what conditions?

- Governance: Can administrators change the rules or edit the ledger?

- Technology: Is the platform built on open-source or proprietary software?

- Consensus: How do participants join the network and validate transactions?

- Accessibility: Are the gateways (exchanges, wallets) reputable and user-friendly?

By asking these questions, your team can gain valuable insights into any platform’s transparency, security, and overall health. This knowledge empowers you to make informed decisions and choose platforms best aligned with business needs and risk tolerance.

Key Takeaway:

By understanding the key roles within a crypto network, you can gain valuable insights into its governance, security, and overall health. This knowledge is essential for making informed decisions and ensuring compliance with relevant regulations.

Enhanced understanding of crypto platform dynamics allows accountants to reconcile transactions with greater insight, which is critical for compliance.

Tip #1 Recap

To recap our first tip, we’ve explored the fundamental concepts of cryptographic assets, distributed ledger technology (DLT), digital scarcity, crypto wallets, and crypto exchanges. These concepts are crucial for Web3 pros to grasp, as they form the foundation for understanding how all cryptos work and how to account for them accurately.

We also discussed the importance of user-friendly platforms and GUIs, and how they impact your integration decisions. By understanding the key roles within a crypto network, such as administrators and participants, you can gain valuable insights into its governance, security, and overall health.

Now that you can explain the crypto basics to your accountant, it’s time to move on to the next essential tip: practicing good crypto governance hygiene. This involves understanding the key considerations and best practices you should implement to ensure compliance and protect your interests.

Tip #2 ~ Practice Good Governance: Access Controls, Wallet Management, and Custody Programs

Providing top-notch Web3 professional services to your clients doesn’t stop after they make their first payment in crypto. You’ll need to outfit your system with good governance practices, to make sure things run smooth as they get going. Look out for three components of good internal governance your team can use to minimize mistakes:

- Comprehensive access controls for crypto on-ramps,

- a robust wallet management system, and

- a carefully designed custody program.

These three components should align with each other to save your firm from costly mistakes. To help things, make sure you keep the below in mind when developing your policies for access to fiat on-ramps:

Authorized Users and Access Control

Establishing clear policies and procedures for authorizing users to access and manage crypto assets is crucial for security and compliance. This rings true for fiat on-ramps, because these systems are the connections between your traditional banking structure and the crypto ecosystem. You should monitor authorized users and control access to on-ramps.

Consider using multi-signature or multi-party computation (MPC) wallets as you grow; they require multiple approvals for transactions to enhance security and control. Policies and procedures should be short and sweet. Remember: both living documents (like workflows and secure access lists) and version-controlled documents (like SOPs and manual revisions) have their place within the procedures. Just make sure you have a system in place to track user accounts and policies to support their creation.

Use Secure Fiat On-Ramps

When your team has identified authorized users and implemented access controls, you are ready to acquire crypto via a centralized exchange (CEX) or a third-party service, like Moonpay,™ on a decentralized exchange (DEX). These on-ramps connect with their business checking or credit card account for making initial crypto purchases.

KYC/AML Compliance

Most reputable CEXs and fiat on-ramps have Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes in place. This helps businesses comply with financial regulations and ensures that their crypto transactions are legitimate. Familiarize yourself with the documentation you and your authorized users will need to provide for business account set-ups and compliance checks.

Account Set-Up and Funding

The account set-up process involves creating an account and completing KYC verification, which may take a few days or weeks. Individual user accounts within the company must follow the KYC process, as well. Once the company and user accounts are approved, you can fund it through various methods, such as wire transfers. It is helpful to implement a simple wallet management system and update it with regularity for robust access control.

Test Transactions

Before sending large amounts of crypto, it’s recommended to to perform test transactions with small amounts to verify the accuracy of the receiving address and the functionality of the platform. This can help prevent costly errors and ensure a smooth experience. It’s also a great way for users to gain experience performing basic tasks and following approval workflows.

Key Takeaways for Web3 Firms

- Take the time to diligently choose secure and compliant crypto on-ramps.

- Respect the importance of KYC/AML compliance and respecting the time it may take to get all users vetted.

- Oversee your team’s secure account setup and funding procedures.

- Recommend test transactions to prevent errors.

- Establish clear policies for authorized users and access control.

By understanding the process of using crypto on-ramps and implementing best practices for security and compliance, you can empower your team to confidently navigate the crypto landscape and protect your assets.

Now, let’s explore how you can further enhance crypto security and practice good governance with a comprehensive and user-friendly wallet management system (WMS).

Implement a Robust WMS

A robust WMS is crucial for safeguarding your crypto assets and ensuring easier compliance. Here are some key tips to help you through the process:

Document the Policy

- Formalize Procedures: Don’t rely on ad-hoc practices. Create a clear, written policy outlining all aspects of wallet management, including:

- Types of wallets allowed;

- Procedures for creating, accessing, and managing wallets;

- Backup and recovery protocols;

- Security measures (passwords, 2FA, etc.); and

- Authorized users and access levels.

Purpose-Driven Wallets

- Segregation of Duties: Don’t use a single wallet for everything. Implement different wallets for different purposes:

- Receiving Payments: A dedicated wallet for receiving customer payments.

- Making Payments: A separate wallet for outgoing transactions (expenses, payroll, etc.).

- Long-Term Storage: Cold wallets for securely holding particular digital assets for indefinite periods.

- Enhanced Security and Tracking: This segregation minimizes risk and simplifies accounting and reconciliation.

Seed Phrase Security

- Seed Phrase Essentials: Educate your team about the critical importance of seed phrases for wallet recovery.

- Secure Storage Policy: Implement a strict policy for seed phrase storage:

- Offline and Secure: Store seed phrases offline in a secure location (e.g., hardware wallet, safe deposit box, encrypted file).

- Multiple Backups: Create multiple backups and store them in different secure locations.

- Limited Access: Restrict access to seed phrases to authorized personnel only.

New Wallet Approval Process

- Control and Oversight: Don’t allow the creation of new wallets without proper authorization. Implement a formal approval process:

- Request Justification: Require a clear business need for a new wallet.

- Review and Approval: Designated personnel (e.g., CFO, IT manager) should review and approve requests.

- Documentation: Maintain records of all approved wallets and their purpose.

Portfolio Tracking

- Centralized Management: Use a portfolio tracker to monitor all wallets in one place. This provides a comprehensive overview of crypto holdings, simplifies reconciliation, and enhances security by enabling early detection of suspicious activity.

- Popular Options: Explore portfolio trackers like Blockfolio,™ CoinStats,™ or Delta.™

Key Takeaway:

By implementing these wallet management tips, your firm can significantly enhance your crypto assets’ security and minimize the risk of loss or theft. Plus, by creating the WMS which best aligns with organizational goals and structure, you can better control your valuable investments for the long haul.

When you put these tips to good use, you’ll want to also make sure to design a suitable custody program to round out your good governance practices.

Design a Custody Program That Works for You

Crypto custody refers to the how you secure and store your crypto assets. Designing a robust custody program is crucial for protecting your investments and ensuring compliance. Here’s some essential insights as you do so:

Self-Custody vs. Custodial Services

- Self-Custody: Your firm manages your own private keys and assets, typically using hardware or software wallets. This offers greater control but requires technical expertise and careful security practices.

- Custodial Services: A third-party custodian (e.g., a specialized crypto custodian or a bank offering crypto services) holds and manages the assets. This can simplify management and enhance security for some, but it involves relying on a third party.

Factors to Consider

- In-House Expertise: How comfortable are you (and your team) with managing private keys and wallets?

- Value of Assets: Higher-value assets might warrant more robust security measures, such as custodial services with multi-signature wallets.

- Regulatory Requirements: Some industries or jurisdictions may have specific custody requirements.

- Insurance: Does you need insurance coverage for your digital assets? Custodial services often include insurance.

Chains and Platforms

- Desired Networks: Which networks do you need to use (e.g., Bitcoin, Ethereum, Solana)? This will influence wallet and custodian choices.

- Platform Compatibility: Ensure the chosen wallets and custody solutions are compatible with the desired platforms (e.g., exchanges, DeFi protocols).

- Future Needs: Consider your firm’s potential future needs and scalability requirements.

Security and Cost Considerations

- Security Measures: Evaluate the security measures offered by different custody solutions, including:

- Multi-signature Wallets: Require multiple approvals for transactions.

- Cold Storage: Offline storage for enhanced security.

- Regular Audits: Independent audits to verify asset security.

- Insurance: Coverage against theft or loss.

- Cost: Custodial services typically involve fees, while self-custody might require upfront investment in hardware wallets or security software. Compare costs and weigh them against the security benefits.

Key Takeaway:

Designing a crypto custody program requires careful consideration about your firm’s business needs, risk tolerance, and your particular crypto holdings. By guiding your team through this process using the above insights, you can establish a secure and compliant custody solution to protect your investments. That way, your long-term success serving Web3 firms will be fortified by a solid WMS.

Tip #2 Recap

As we’ve discussed, strong governance practices are essential for secure and compliant crypto management. By guiding your team to implement robust controls, establish a strong WMS, and define a robust custody program, you can navigate crypto complexities with greater confidence. Now, let’s explore the next crucial step in the process: ensuring accurate bookkeeping and compliance once you get going.

Tip 3 ~ Ensure Accurate Bookkeeping & Compliance: A Step-by-Step Guide for Web3 Pros

This outline provides a comprehensive framework for ensuring your firm establishes a compliant crypto accounting system fit for your finance team. Here’s a breakdown of each step with additional context and considerations:

1. Craft a Compliant Crypto Accounting System

- Establish a Foundation: This is the crucial first step. Design a system that aligns with the relevant accounting standards (e.g., ASU 2023-08) and tax regulations.

- Key components of a compliant system:

- Supports accurate recordkeeping;

- Safeguards digital assets;

- Streamlines financial reporting;

- Contains robust internal controls;

- Scales with growth;

- Integrates with the your current accounting system.

2. Determine Digital Asset Eligibility

- ASU 2023-08 Guidance: Refer to ASU 2023-08 to determine whether a crypto asset meets the criteria for intangible asset recognition.

- Key Considerations:

- Does the asset meet the definition of an intangible asset?

- Is it created or acquired for internal use?

- Does it have an indefinite useful life?

- Accurate Classification: Proper classification is essential for compliance and accurate financial reporting.

3. Evaluate and Categorize Transactions

- Transaction Analysis: Carefully analyze each crypto transaction to determine its nature and purpose (e.g., purchase, sale, exchange, mining, staking).

- Accurate Categorization: Assign the correct accounting treatment based on the transaction type and relevant accounting standards.

- Documentation: Maintain detailed records of all transactions, including dates, amounts, and supporting documentation.

4. Update Your Cost Basis Tracker

- Cost Basis Tracking: Implement a system for tracking the cost basis of each crypto asset. This is crucial for calculating gains and losses for tax purposes.

- FIFO, LIFO, or Specific Identification: Choose an appropriate cost basis method (FIFO, LIFO, or specific identification) and apply it consistently.

- Software Solutions: Utilize crypto-specific accounting software that automates cost basis tracking.

5. Integrate and Synchronize Your Ledgers

- Integration with Existing Systems: Ensure seamless integration between your crypto accounting system and your general ledger.

- Data Synchronization: Regularly synchronize data between systems to maintain accuracy and consistency.

- Automated Solutions: Explore software solutions that automate data integration and synchronization.

6. Reconcile and Close Crypto Activity

- Regular Reconciliation: Perform regular reconciliations between your crypto records and exchange/wallet statements.

- Investigate Discrepancies: Identify and resolve any discrepancies promptly.

- Period-End Closing: Close out crypto activity at the end of each accounting period, ensuring accurate financial reporting.

7. Review, Support, and Prepare Reports

- Ongoing Review: Regularly review your crypto accounting processes and controls to ensure compliance and efficiency.

- Document Support: Include supporting documents on crypto-related transactions for smooth audit, bookkeeping, and tax matters.

- Reporting: Generate accurate and timely reports, including:

- Portfolio valuations;

- Transaction summaries; and

- Tax and period reports.

Tip 3 Recap

By implementing these steps and utilizing the right tools, you can ensure compliant and accurate crypto accounting for your Web3 firm. This will not only protect you from potential penalties and audits but also provide you with the reliable financial information you need to make informed decisions.

Now, let’s move on to the next tip: assessing and mitigating the known risks associated with crypto assets.

Tip #4 ~ Master Crypto Risk Assessment and Mitigation for Your Best Fit

As your firm delves deeper into using cryptos, it’s crucial to bear in mind their unique attributes and varieties. Each comes with its own set of risks and challenges.[3] Therefore, the next essential tip is to make sure your firm has a plan to assess and mitigate these risks. After all, what good are digital assets if you are unsure about trusting them?

One simple way to build trust is to learn the potential risks. These can generally be categorized as hacks, forks, smart contract bugs, crashes, network attacks, and phishing. Let’s explore each with greater detail.

Hacks

Hacking is one of the top known risks with using crypto. Not surprising, huh? Hackers use faulty code to disrupt, amend, or obfuscate ledger activity, which may result in stolen or lost funds. That’s why many crypto platforms use common computer languages and FOSS: to ‘outsource’ bug or glitch hunting. The knowledgeable masses can offer greater protection against hacks than a smaller, private team. Thus, the logic goes, “If programmers use a common software en-masse, odds are any vulnerabilities will be discovered quickly.”

Therefore, the key to lowering your hacking risk is to use an established crypto platform. One with a solid track record and an experienced community of professional developers which support it. Oftentimes, a hack doesn’t necessarily target an entire network, but an exchange wallet or smart contract.

Accountants and finance team members should remember to follow common sense cyber security rules when using new wallets and dApps.

Even though you can hedge against hacks, they can be a pain. For example, take a peek at what happened to the Ethereum blockchain after the DAO hack. These hacks can result in costly problems like tricky governance dilemmas or forks.

Forks

Cointelegraph™ has a good refresher about forks, if you need one. But mainly, two types of forks, hard and soft, can increase your risk. Soft forks are upgrades which allow backwards compatibility with your wallet. They’re generally less risky and disruptive.

Hard forks, however, lead to at least two permanently separated chains. As you can imagine, these chains lack compatibility but possess a certain quantity of similar transaction history. Hard forks can lead to lost funds, confusion, or lack of technical support for the “old” chain and/or wallet.

That’s why you want to know if your client’s chosen crypto’s chain has forked, may fork, or if governance rules even allow for forking. A safer crypto may be more resistant to forking or outline a process for all users to retain their crypto should a fork occur. In fact, when a successful hard fork occurs, legacy chain users often end up with double money!

Even though forking risk may seem nascent, be aware of the reasons other chains have forked. Like the Ethereum example above. You’ll better understand key players’ interactions and gauge user sentiment with greater precision. Important aspects for safer crypto use.

Smart Contract Bugs

Similar to hacking, cyber criminals use bugs in smart contracts to make away with your hard earned crypto. In fact, that’s precisely what happened with the DAO hack. A function in the code (‘split’) contained a vulnerability for the criminal(s) to steal crypto. The DAO’s smart contract was even “verified”.

Verified smart contracts are generally considered safer than the alternative. Find out by visiting a block explorer, like Etherscan,™ and look for a check mark next to the ‘contract’ tab on the overview screen.

Use the tech to your advantage. Use block explorers and other free tools like Tokensniffer™ to gain a sense of smart contract security. Unfortunately, smart contract bug exploits do happen and can crash entire networks. So, be smart about smart contracts.

One item to note about bugs: algorithms within smart contract code can have bugs, too. Stablecoins can lose their peg due to flaws in automated market makers (AMMs) algorithms, for example. The Terra™ stablecoin crash comes to mind.

Crashes

Everyone knows about crypto crashes. They’re self-explanatory: the network goes down (for whatever reason) and transactions grind to a halt. If you can’t send your crypto, you can’t spend your money. Unusable money can lose value, fast. Network crashes are by far the worst outcome of any known risk, because they can result in permanent loss of funds, wasted capital equipment, or supply chain disruptions.

Hedge your crash risk by using cryptos on networks which have proven consensus mechanisms and many disparate, disaggregated participants.

One final note about crash risk: be mindful about the centralized exchange you choose. Namely, note those which have received notices (like cease-and-desist orders) from regulatory bodies. Perform a quick search about any lawsuits directed at your chosen exchange, too. Compliance issues can be red flag warnings about underlying problems. Problems which could lead to a crash.

Network Attacks

A network attack is another risk. Different types of network attacks may impact different layers of the protocol. I wrote a paper to help you better understand cryptos’ protocols. Common attack types are Sybil attacks, 51% attacks, long range attacks, and Denial-of-Service (DOS) attacks. They are similar in they all attempt to disable or disrupt the network from performing as intended for users.

Here’s a great resource regarding blockchain security, published by Hacken.™

More mature and decentralized networks are generally more protected from network attacks than otherwise. The takeaway is to keep your ear close to the ground around your (or your Web3 clients’) chosen cryptos’ networks and participants. Network participants usually stand to lose more than the typical user, so understanding their activities gives you quick actionable insight about any potential network problems.

A good way to do this is to use a tool like Arkham™ to monitor exchange wallets. I recommend setting up alerts about large transactions or from flagged wallets or entities. Could be a good way to remain aware of potential vulnerabilities.

Phishing

Last on our list are plain ‘ol phishing attacks. Yep, you guessed it: crypto users (such as inexperienced finance staffers) can be particularly vulnerable to phishing attacks because thieves prey on the unsuspecting. You can prevent becoming a phishing victim by understanding how and where these attacks occur. That way, you’ll know how to spot them and can avoid the attack entirely.

Similar to spam emails, crypto wallets are susceptible to spam crypto airdrops. Generally, they seem innocent and may even look like a reputable coin, such as a stable coin. It is airdropped into your wallet and made to appear legit.

But it’s not.

These deposits may contain links to fake sites, accounts, or codes. Unwittingly you’ll provide private key or login credentials via these fake GUIs when you follow the prompt. You’re handing your keys directly to the thief. No bueno.

Always keep in mind: whomever controls the private keys, controls the crypto. So the most effective way to keep your firm safe from phishing attacks is to:

- Know the cryptos’ activity in your wallet;

- Don’t trust unsolicited airdrops;

- Use tech (like Tokensniffer™ or block explorers) to verify security, if things don’t feel right;

- Never share private keys or seed phrases with anyone outside the guidance of the WMS policy.

By applying these tips, you’ll foster improved habits for your company to use crypto in a safer way.

Tip 4 Recap

At this point in your due diligence, you’ve identified a user-friendly crypto asset and verified its reputation. You trust its consistent performance after validating the professional development and support community. Finally, you’ve familiarized yourself with its known risks and feel ready to determine which digital assets are right for your firm. When you do, make sure to keep informed about key aspects driving each crypto ecosystem, relative to your ops.

Tip 5 ~ Stay Informed About Best Practices, Tools, & Crypto Accounting Regulations

The crypto accounting landscape is constantly evolving, with new technologies, regulations, and best practices emerging all the time. To effectively guide your Web3 pro services firm and protect your interests, it’s crucial to stay informed and adapt your strategies accordingly.

Here are the key areas to stay informed about:

Accounting and Tax Regulations

- Stay up-to-date on the latest accounting standards and tax regulations related to cryptocurrencies like ASU 2023-08.

- Understand the evolving guidance from regulatory bodies like the FASB and IRS.

- Utilize resources and tools to ensure accurate and compliant crypto accounting and tax reporting.

Security Best Practices

- Keep abreast of the latest security threats and vulnerabilities in the crypto space.

- Educate your clients on best practices for securing their digital assets, such as using hardware wallets, strong passwords, and two-factor authentication.

- Advise them on how to avoid scams and phishing attacks.

Emerging Technologies and Tools

- Stay informed about new crypto technologies and tools that can benefit your clients, such as decentralized finance (DeFi) platforms, blockchain analytics tools, and portfolio trackers.

- Evaluate and implement relevant tools to help your company, vendors, and customers improve your transactions.

Resources for Staying Informed

- Industry Publications: Follow reputable crypto news sources and industry publications.

- Professional Organizations: Join professional organizations that focus on crypto adoption, accounting, and taxation.

- Continuing Education: Participate in webinars, conferences, and training programs to enhance your crypto knowledge and skills.

- Regulatory Websites: Regularly check the websites of relevant regulatory bodies for updates and guidance.

Tip 5 Recap

For professional service firms, staying ahead in digital asset developments is a strategic imperative for providing top-notch performance. Continuous learning is no longer just beneficial; it’s essential for ensuring financial protection, maintaining compliance, and fostering preparedness in this rapidly evolving Web3 landscape. This means proactively understanding evolving regulations, emerging technologies, and industry best practices. Firms must also strategically tailor their digital asset expertise to client-driven factors such as industry, risk tolerance, and financial goals. By continuously expanding your firm’s knowledge and skills in these critical areas, you empower your firm to confidently navigate challenges and capitalize on opportunities, while ensuring robust protection and compliance.

Saving Clients from Crypto Mistakes: 5 Essential Tips for Accountants

By using these five tips, you’ll be well on your way to enlightening your finance and accounting team, upgrading your digital treasury, and improving your compliance. All while saving yourself from costly mistakes. Not bad for a quick readthrough.

So, to make things even simpler, here’s a full 5-tip recap:

- Educate Your Team on the Crypto Basics:

-

-

- Ensure your finance team understands foundational crypto concepts (wallets, keys, DLT).

- Provide resources to avoid falling victim to common scams and misunderstandings.

-

- Securely Manage Crypto Wallets and Keys:

-

-

- Emphasize secure storage practices (hardware wallets, backups, strong passwords).

- Recall the risks of custodial solutions when establishing treasury structure.

-

- Ensure Accurate Bookkeeping & Compliance:

-

-

- Implement compliant accounting systems for crypto transactions.

- Maintain accurate cost basis tracking and transaction categorization.

-

- Assess and Mitigate Known Risks:

-

-

- Help your vendors and customers identify and understand potential crypto risks (hacks, forks, etc.).

- Guide your staff in developing risk mitigation strategies for internal controls.

-

- Stay Informed About Best Practices, Tools, & Regulations:

-

- Keep abreast of evolving crypto regulations and industry best practices.

- Utilize resources to provide up-to-date guidance to staff.

We’ve distilled the most important points into this easy-to-digest infographic, making it simple to remember and apply these vital digital asset compliance tips.

You’ll empower your firm to minimize crypto risks and maximize opportunities by applying these five tips. Guide them in prioritizing security, compliance, and user-friendly platforms. Then, assist them in establishing accurate crypto accounting practices.

Take the stress out of crypto bookkeeping and accounting. We provide comprehensive support to help you manage your digital assets with confidence.

Contact us to learn more.

Sources

- Mahjoub, Y. Idel, M. Hassoun, and D. Trentesaux. “Blockchain Adoption for SMEs: Opportunities and Challenges.” IFAC-PapersOnLine 55, no. 10 (2022): 1834-1839.

- Manski, Sarah, and Michel Bauwens. “Reimagining New Socio-Technical Economics Through the Application of Distributed Ledger Technologies.” Frontiers in Blockchain 2 (2020): 29.

- Zhang, Rui, Rui Xue, and Ling Liu. “Security and Privacy on Blockchain.” ACM Computing Surveys (CSUR) 52, no. 3 (2019): 1-34.